2015

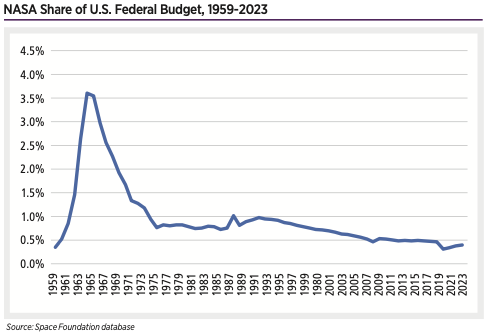

Leap Second Adjustments to UTC, Navigation Satellites, 1972-2023

But every technological leap in clock accuracy can’t overcome the wobbly planet’s ability to throw off timing standards. Using leap seconds, the International Bureau of Weights and Measures has changed clocks to match the astronomical time on Earth 27 times.

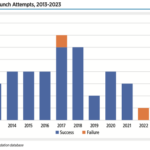

Japanese Launch Attempts, 2013-2023

One problem area for Japan is the possibility of a gap in reliable access to space. The nation is one of 10 capable of orbital launch, but its launch activity is relativity infrequent.

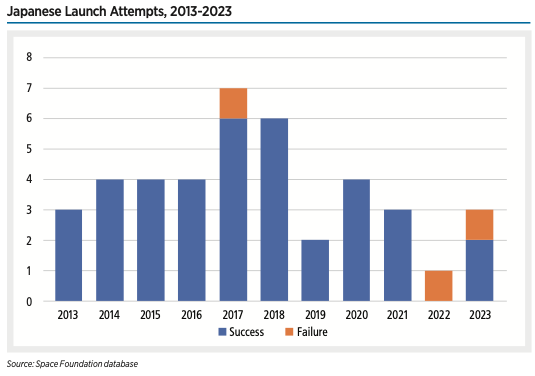

Japanese Workforce by Sector, 2005-2021

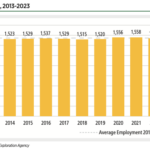

JAXA employed 1,580 individuals at the beginning of 2023. Out of this total, 1,123 (71%) are engineering and research employees. Even though Japan as a whole is struggling with an aging population, JAXA’s age demographics are more normally distributed than many other nation’s space agencies.

University Nanosatellite Launches Skyrocket Over Past Decade

Universities across the globe are building an increasingly large presence in space by attaching student satellite projects to launches. Since the advent of nanosatellites and CubeSats, the barrier to space entry has never been lower for students.

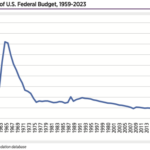

NASA Share of U.S. Federal Budget, 1959-2023

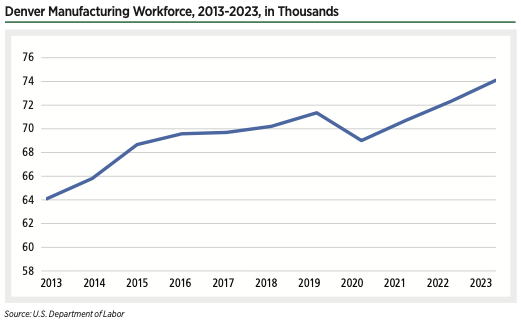

Denver Manufacturing Workforce, 2013-2023

But in the bustling Denver market, where overall unemployment hovers near 3%, demand for manufacturing workers is at a 10-year high.

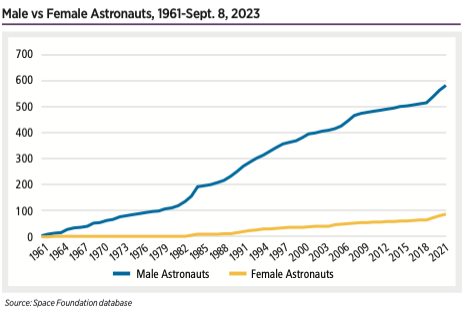

Male vs Female Astronauts, 1961-Sept. 8, 2023

The most significant human spaceflight trend in recent years has been a shift to focus on diversification.

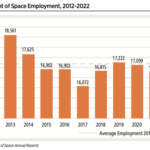

India Department of Space Employment, 2012-2022

India has traditionally maintained a large government workforce relative to its private space workforce. However, in recent years, the Indian government has been working to grow its commercial space sector.

JAXA Workforce, 2013-2023

Japan is continuing its efforts to promote the growth of new entrepreneurial space efforts. Proposed legislation in Japan would allow JAXA to create a fund to invest in private-sector businesses.

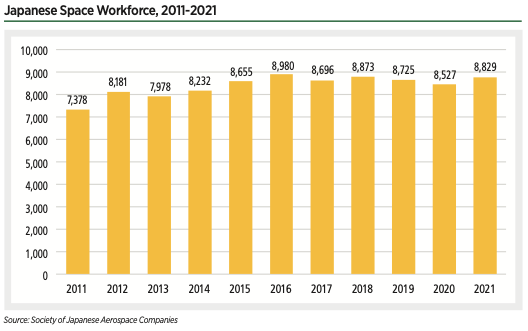

Japanese Space Workforce, 2011-2021

Japan saw growth across all three of these sectors in the past year, with the largest growth, 12.8%, in software.