Interactive Tables and Charts

Data Economy

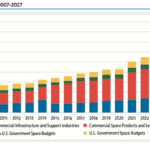

Global space activity by category, 2007-2027

The global space economy totaled $546 billion in 2022, 8% higher than 2021 — and it could reach $772 billion by 2027, according to Space Foundation analysis. Commercial space continues to make up the majority (78%) of this total, but preliminary data shows that 81% of governments with space programs increased spending in 2023.

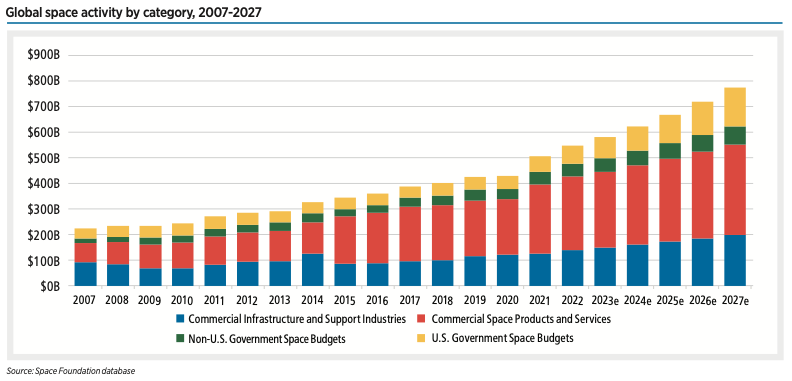

Proportion of governments that increased space spending, 2018-2023

Preliminary data shows that 81% of governments with space programs increased spending in 2023.

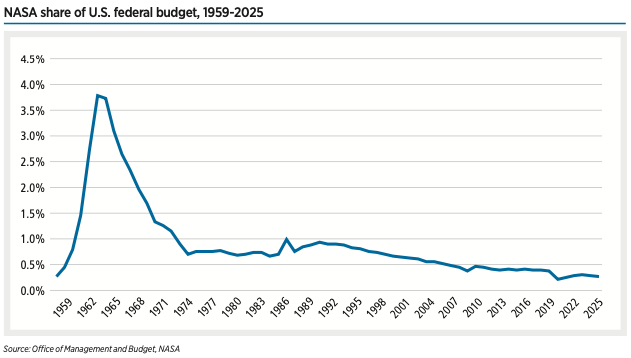

NASA share of U.S. federal budget, 1959-2025

The overall Pentagon budget proposal for 2025 is $850 billion, $8 billion more than its 2024 request.

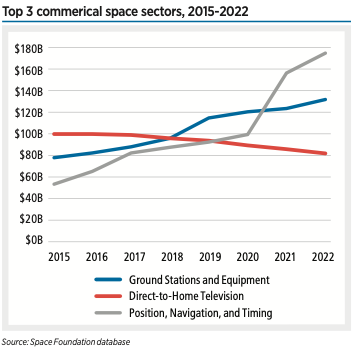

Top 3 commercial space sectors, 2015-2022

Commercial revenues continue to make up the majority (78%) of the global space economy. The top three commercial space sectors — ground stations, direct-to-home television, and position, navigation, and timing — totaled $373 billion in 2022.

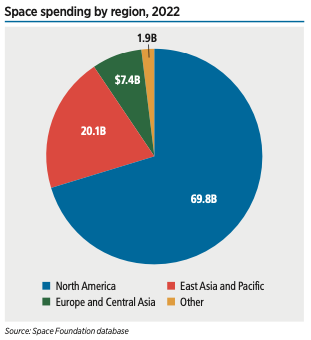

Space spending by region, 2022

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the…

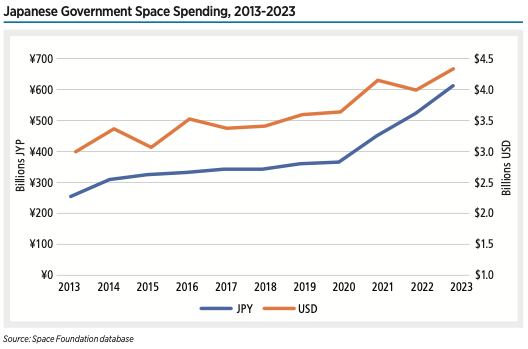

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the… Japanese Government Space Spending, 2013-2023

Japan’s space spending spans seven ministries and totaled ¥612 billion (UD$4.3 billion) in 2023. This budget has grown 68% since 2020 as the nation expands its civil and military space programs. The Ministry of Education, Culture, Sports, Science, and Technology (MEXT) — which houses JAXA — typically receives the majority of space-related funding.

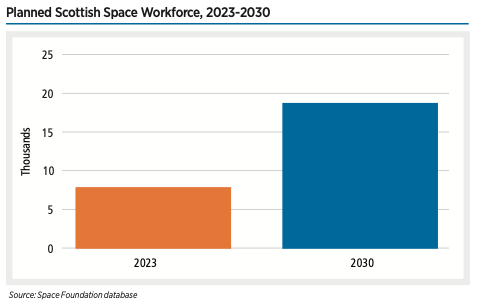

Planned Scottish Space Workforce, 2023-2030

Scotland increasingly sees its future in orbit, with the Scottish Parliament planning to more than double its space workforce to 20,000 workers by 2030.

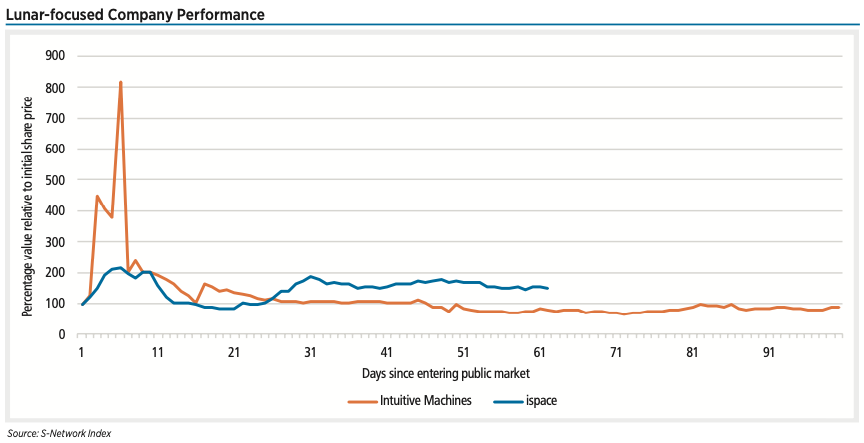

Lunar-focused Company Performance

The two new lunar-focused companies that entered the market in the first half of 2023, Intuitive Machines and ispace, are showing a relative degree of stability in their share prices after some initial volatility in the early days.

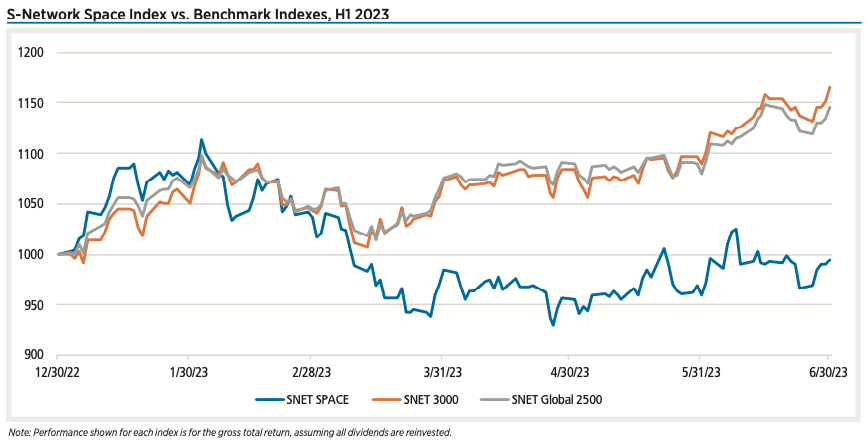

S-Network Space Index vs. Benchmark Indexes, H1 2023

In the first half of 2023, the S-Network Space Index (SNET SPACE) underperformed other benchmark indexes, declining 0.6%. This compares to a 17% increase for the S-Network U.S. Equity 3000 Index (SNET 3000), which tracks the 3,000 largest (by market capitalization) U.S. stocks.

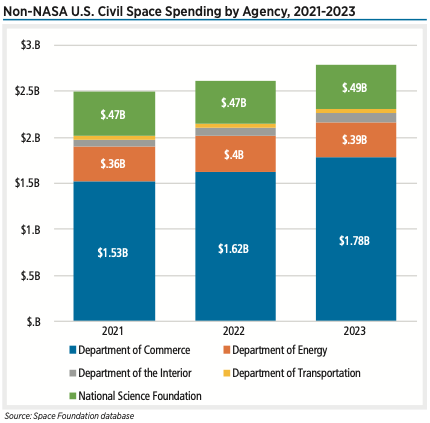

Non-NASA U.S. Civil Space Spending by Agency, 2021-2023

The Department of Defense’s unclassified space spending totaled $17.1 billion in 2022. Space Foundation also estimates total defense space spending, including classified and unclassified budgets for all military branches and intelligence agencies. This estimate reached $42.9 billion last year, a 21% increase year-over-year.