Interactive Tables and Charts

Data Economy

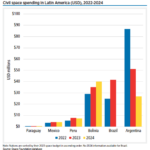

Civil space spending in Latin America (USD), 2022-2024

Like Africa, Latin America has a budding presence in the space economy, and six nations in the region had space budgets available for this analysis.

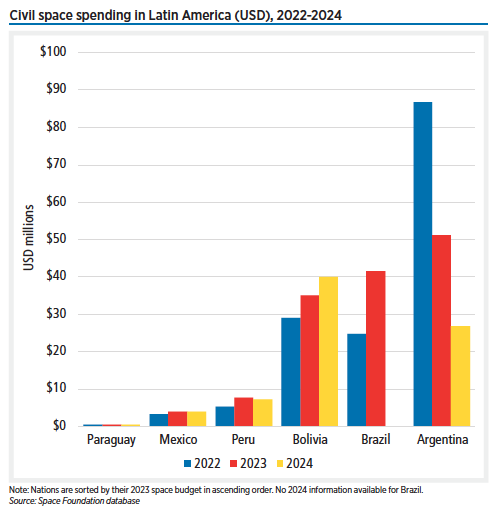

Canadian Space Agency spending, FY2021-FY2026

Canada also is increasing its international cooperation beyond ESA programs. The nation hosted 25 Artemis Accords signatories in May for a workshop on sustainability and safety principles in space exploration.

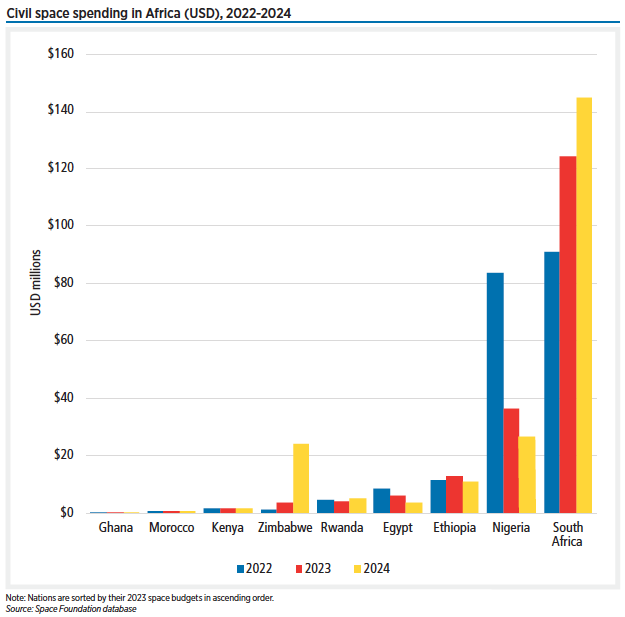

Civil space spending in Africa (USD), 2022-2024

Nine African nations have preliminary budget data available for 2024. As in 2023, seven nations in the region maintained or increased spending, while Egypt and Ethiopia decreased space budgets.

Earth observation revenue, 2014-2023

Access Markets International estimates that the global Earth Observation sector generated $5.9 billion in revenue in 2023, up 8% over $5.4 billion in 2022.

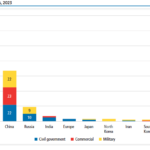

Orbital launch attempts, 2023

The number of launches continued to grow rapidly, with 223 launches — 211 of them successful — attempted in 2023 compared to 186 attempts in 2022.

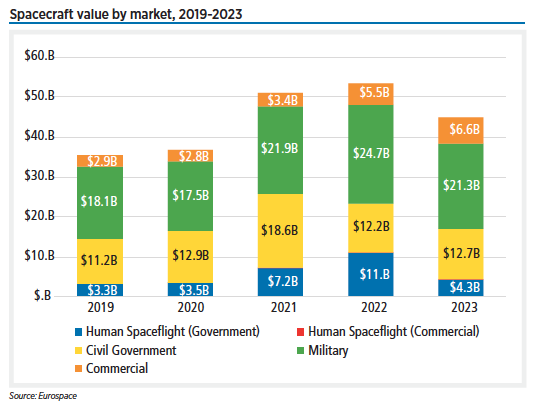

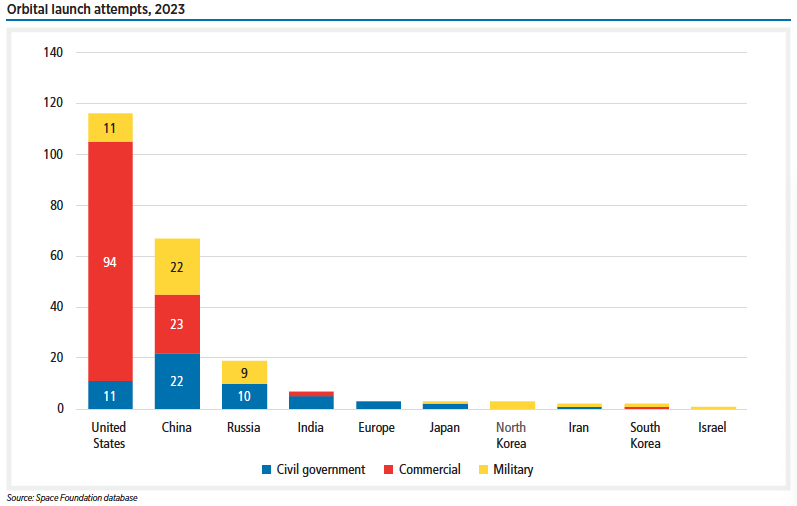

Launch value by market, 2019-2023

The market value of uncrewed commercial launches conducted in 2023 was $3.9 billion. This is an increase of 35% compared to the $2.9 billion in revenue in 2022, driven largely by the accelerating deployment of the Starlink constellation.

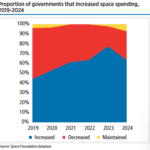

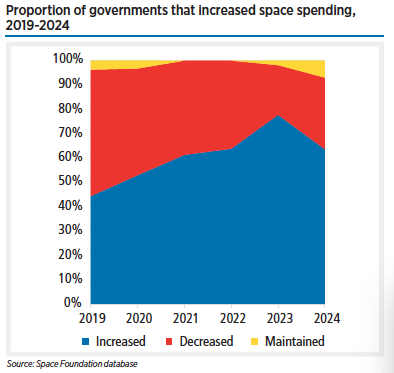

Proportion of governments that increased space spending, 2019-2024

On the government side, international space spending grew 11% to $125 billion. The United States accounted for 59% of government spending between its civil and military space programs.

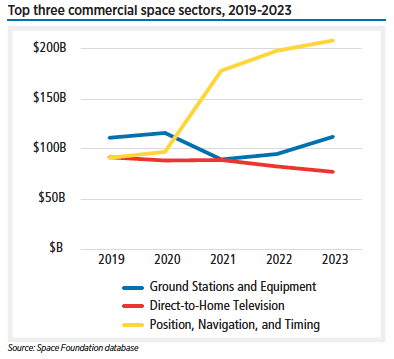

Top three commercial space sectors, 2019-2023

Commercial revenues totaled $445 billion in 2023, 6.5% higher than the prior year. Position, Navigation, and Timing (PNT) increased slower than overall commercial revenues, growing 5.4% last year. Despite the smaller magnitude of the Ground Stations and Equipment revenues (about half the size of PNT), the category grew 18% in 2023. Direct-to-Home Television, the third-largest category, continued its gradual five-year decline.

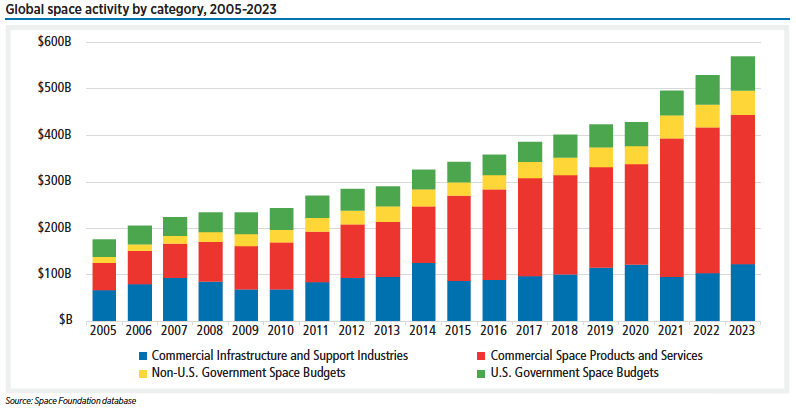

Global space activity by category, 2005-2023

Commercial space revenues, which make up the majority of the space economy, grew 6.5% in 2023 to reach $445 billion. Government space spending increased by double digits for the third year in a row and reached a peak in the proportion of nations increasing their space budgets.

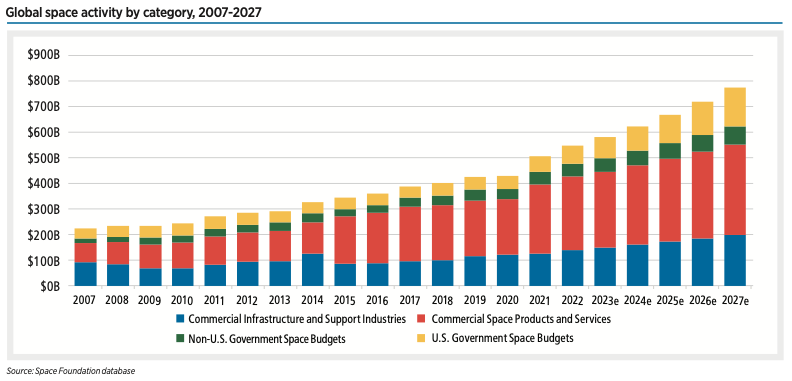

Global space activity by category, 2007-2027

The global space economy totaled $546 billion in 2022, 8% higher than 2021 — and it could reach $772 billion by 2027, according to Space Foundation analysis. Commercial space continues to make up the majority (78%) of this total, but preliminary data shows that 81% of governments with space programs increased spending in 2023.